Demystifying Security Exemption Filings: What They Are and Why They Matter

March 20, 2025

Introduction

In the world of raising capital, understanding security exemption filings is crucial for companies and their legal advisors. These filings, such as the SEC’s Form D, allow businesses to lawfully raise funds under certain exemptions without undergoing a full securities registration. But skipping or mishandling these filings can lead to compliance nightmares.

In this article, we’ll explore what security exemption filings are, why they matter for companies and law firms, and how the traditional filing process works. By the end, you’ll have a solid grasp of this cornerstone of securities compliance and why it’s essential to get it right.

What Are Security Exemption Filings?

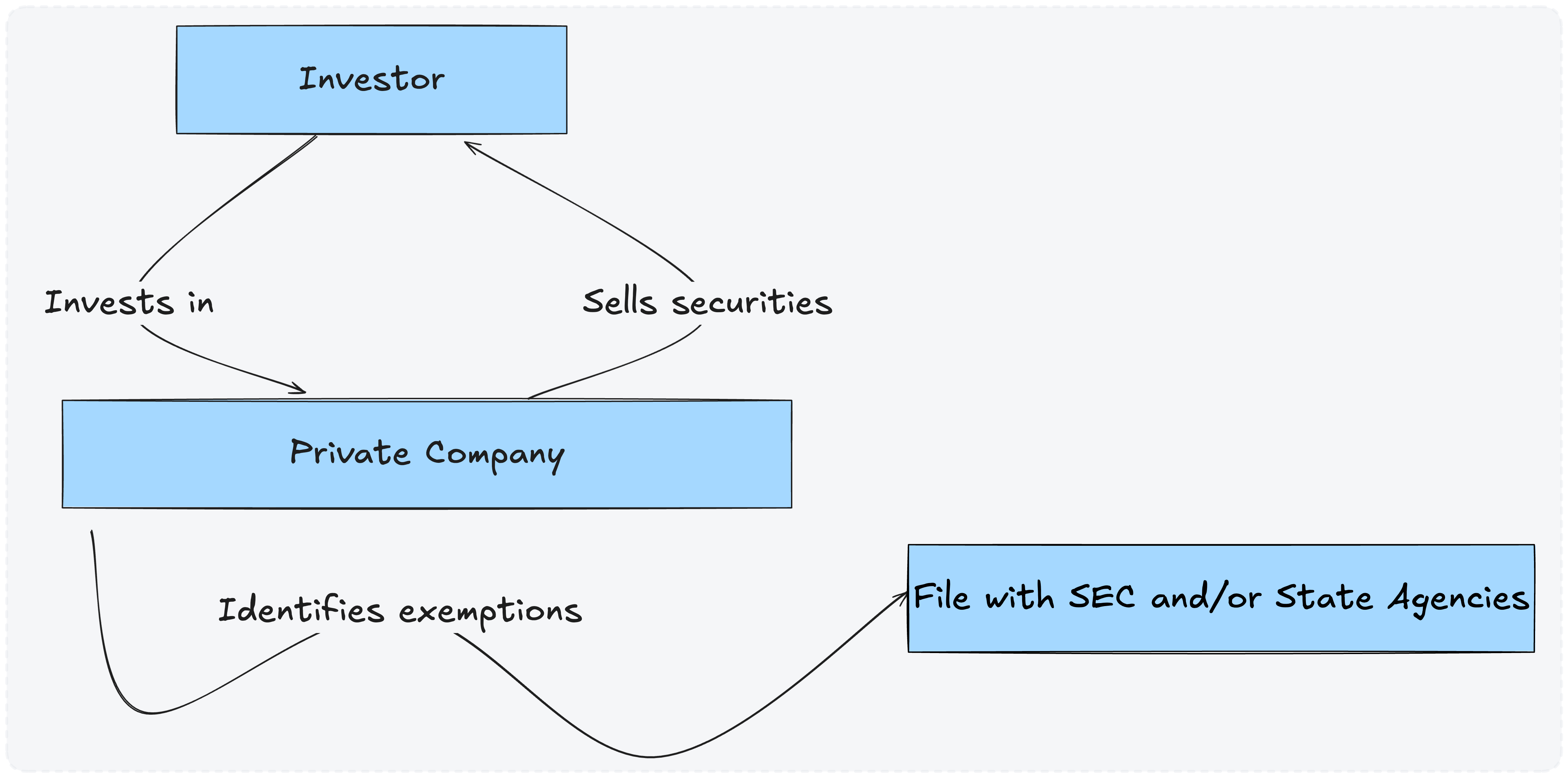

Security exemption filings are notices companies file with regulators to report certain securities offerings that are exempt from full SEC registration. The most common example is Form D, which companies must file with the U.S. Securities and Exchange Commission (SEC) when they sell securities under an exemption (such as Regulation D).

Unlike a full registration statement, a Form D is a brief filing that provides key details about the offering — such as the company’s information, the size and date of the offering, and the names of executives.

These filings are grounded in U.S. securities laws. Under the Securities Act of 1933, offerings must either be registered with the SEC or qualify for an exemption. Common exemptions like Regulation D (Rules 504, 506(b), 506(c)) allow companies to raise capital from accredited investors without registering each offering.

However, even under these exemptions, the issuer is obligated to file a notice (Form D) with the SEC within a specified timeframe.

📌 The exemption spares the company from full registration — not from reporting the sale via an exemption filing.

Why Do They Matter?

Security exemption filings matter for several reasons:

- ✅ Legal compliance

- ✅ Investor transparency

- ✅ Risk mitigation

First and foremost, they are legally required. For example, Form D must be filed no later than 15 days after the first sale of securities in an exempt offering. If an offering is ongoing, an annual update is required, and late filings can trigger penalties that vary by state. The SEC has enforcement authority, and recent cases show they are serious about timely filings.

🚨 In late 2024, the SEC announced charges against companies that failed to file Form D on time, with fines ranging from $60,000 to $195,000.

The message is clear: missing or delaying a required exemption filing is not without consequence.

Beyond avoiding fines, these filings serve an important purpose in the regulatory ecosystem. They provide regulators and the public with critical information on private capital markets. As one SEC official emphasized, “Form D filings are crucial sources of information on private capital formation,” and timely compliance is vital to protecting investors while facilitating small business capital raising. By disclosing who’s raising money and how, Form D notices help ensure a level of transparency even when offerings are private. Investors and state regulators can lookup these filings to verify that a company is properly availing itself of an exemption, which in turn builds trust.

In short, security exemption filings are not mere paperwork. They are a legal obligation and a key part of the checks and balances in securities law. Companies that ignore them risk losing the benefits of the exemption safe harbor and facing enforcement actions, which can damage both finances and reputation. For law firms and compliance professionals, ensuring these filings are done right and on time is a fundamental duty to their clients.

The Traditional Filing Process

How do companies or their law firms actually file a security exemption notice? The traditional process centers around gathering information and navigating the SEC’s EDGAR system. Here’s an overview of how a Form D filing (the quintessential security exemption filing) typically works:

-

Preparing the Information: First, the issuer assembles the required details about the offering and the company. This includes information like the entity’s name and address, executives and related persons, the type of securities offered, the exemption rule being relied upon (e.g., Rule 506(b) or 506(c) of Reg D), the amount raised or expected, and the number of investors. While Form D is much shorter than a public offering registration, it still requires careful compilation of data. Often, law firm associates or paralegals fill out a checklist of all the needed info to ensure nothing is missed (for example, whether any sales commissions are paid, or if any investors are not accredited, etc.).

-

EDGAR Account Setup: To file electronically, the company (or the filing agent, such as a law firm) must have access to the SEC’s EDGAR (Electronic Data Gathering, Analysis, and Retrieval) system. Traditionally, this meant obtaining an EDGAR CIK (Central Index Key) number for the company and a set of access codes (password, passphrase, and CCC) using a Form ID application. This EDGAR access is essential because since 2009 the SEC has required Form D to be filed online — no more paper submissions. To add to the complexity, EDGAR Legacy and EDGAR Next follow two different processes.

-

Filing on EDGAR via the Legacy Portal: Using the EDGAR website, the filer logs in with the credentials and accesses the “Form D” electronic form. The form can be completed via an online interface where the information is entered into various fields. The traditional process is largely manual data entry: the person filing will input the offering details, double-check for accuracy, and then submit the form through EDGAR. Upon submission, a confirmation is generated and the Form D becomes part of the public filings. In addition to the federal filing, companies may also need to comply with “Blue Sky” filings at the state level (states often have notice filing requirements and fees for the same offering). Historically, that meant preparing separate filings or using the NASAA EFD system for state notices, adding to the workload.

-

Timing and Follow-Up: Timing is critical. As noted, the Form D should be filed within 15 days of the first sale in the offering. Paralegals often mark this deadline on the calendar as soon as a private placement closes its first investment. After filing, if the offering is ongoing, the team must remember to file an amendment or annual update on the one-year anniversary. The traditional process to manage these deadlines has been through diary systems or spreadsheets – essentially human reminders. Any changes in the offering (like extending the offering or changes in executive officers or amount offered) may prompt an amended filing as well. Ensuring these follow-ups are done properly is part of the ongoing compliance workflow.

🧠 The traditional approach is manual, error-prone, and time-consuming. Many firms assign paralegals to handle these tasks exclusively.

Each filing requires meticulous attention, and there is plenty of room for mistakes — a typo in an issuer’s name, a wrong number in the amount raised, or a missed deadline. Such errors can require refiling or, worse, could raise red flags with regulators. That’s why many law firms have dedicated staff, like paralegals or junior attorneys, who specialize in managing Form D and Blue Sky filings for transactions. It’s also why there is growing interest in automating this process (something we’ll explore in a later article). For now, suffice it to say that doing it “the old way” means investing significant time and care into what is essentially an administrative regulatory task.

Conclusion

Security exemption filings are the unsung heroes of private capital markets compliance.

They enable companies to raise capital efficiently under exemptions while maintaining transparency and meeting legal obligations.

From understanding the basics (like Form D) to navigating the legacy EDGAR process, it’s clear that no serious company or law firm can afford to ignore these filings.

🚀 How PaxAI Can Help

If your team is spending too much time on manual Form D submissions or stressing over compliance gaps — or if you're a client paying substantial legal fees for these routine tasks — there’s a better way.

PaxAI’s AI-powered digital paralegal is built to:

- Streamline securities filings

- Eliminate human error

- Keep your filings on time and on track

Want to learn more?

- 👉 Demo Page: See PaxAI in action on a live demo.

- 📧 Contact Us: Reach out to our team with any questions.

Let PaxAI ensure your exemption filings are timely, accurate, and hassle-free, so you can focus on what matters — serving your customers.